S&P Report: Stablecoin Legislation Could Boost U.S. Market Presence, Disrupt Tether’s Dominance

25/04/2024

Russia’s Central Bank and Rosfinmonitoring Launch Pilot Program to Track Links Between Cryptocurrency Transactions and Fiat Operations

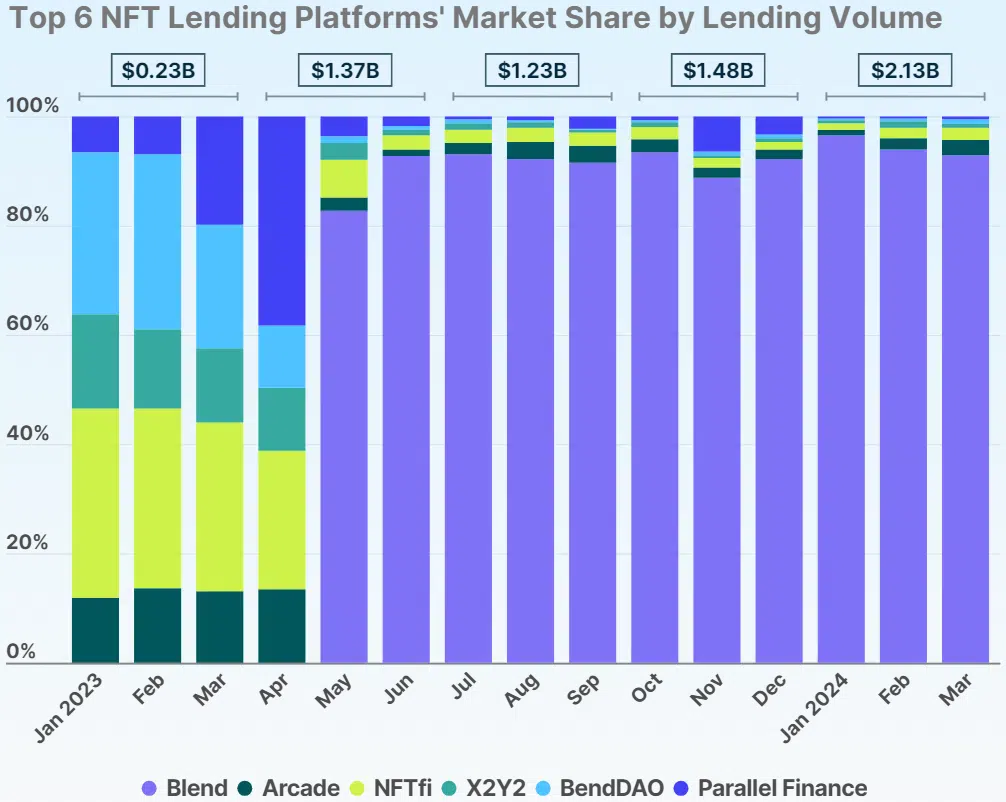

27/04/2024NFT Lending Volume Soars to $2.13 Billion in First Quarter, Marking a 43.6% Increase

The non-fungible token (NFT) lending sector experienced unprecedented growth in the first quarter of the year, with the market hitting a new high of $2.13 billion, a surge of 43.6% from the previous quarter, as reported by CoinGecko.

January set a new monthly record with NFT lending volumes reaching $0.90 billion, overtaking the previous high of $0.85 billion seen in June 2023. Leading the charge, Blend dominated the market, securing a 92.9% market share with a substantial $562.33 million in lending volume in March alone.

Other key players like Arcade and NFTfi also saw increases in their lending volumes, albeit with smaller market shares of 2.8% and 2.2%, equating to $16.94 million and $13.3 million, respectively. Lesser-known platforms such as X2Y2, BendDAO, and Parallel Finance (formerly known as ParaX) also contributed, holding shares of 0.8%, 0.8%, and 0.5% respectively.

To further engage users and enhance trading volumes, NFT lending platforms have introduced various promotional activities. For example, Arcade, supported by Pantera Capital, launched the “Clash of Clans” airdrop in late February. This initiative plans to distribute ARCD tokens across 4,000 wallets, with each wallet eligible to claim 750 ARCD tokens. Similarly, platforms like X2Y2 and BendDAO have also introduced their own tokens aimed at fostering community involvement.

Links: