Solana investors’ appetite shift as O2T rallies 500%

06/04/2024

Russia’s central bank foresees full-scale CBDC implementation post-2029

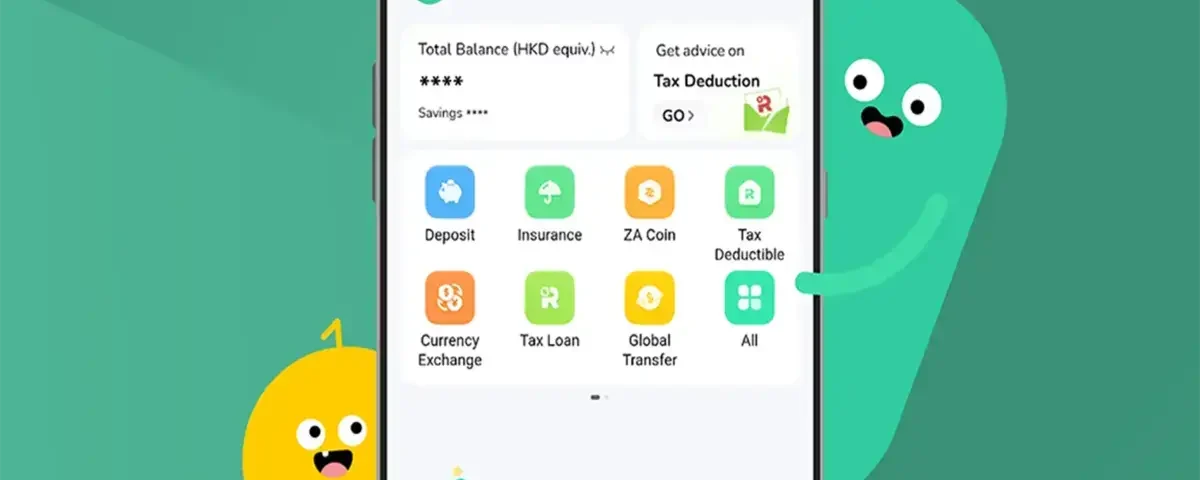

08/04/2024ZA Bank in Hong Kong has unveiled plans to offer specialized banking services tailored for stablecoin issuers, aiming to drive adoption of web3 technologies within the local ecosystem.

The virtual bank, headquartered in Hong Kong, announced on April 5 its intention to provide secure storage for fiat reserves, which stablecoin issuers can utilize to back their digital assets. Additionally, ZA Bank will extend various banking services including fund transfers, payroll management, and a range of deposit options to stablecoin issuers.

Devon Sin, alternate chief executive of ZA Bank, emphasized the institution’s steadfast commitment to the web3 community, stating, “With these new services, we’re directly addressing the unique challenges faced by stablecoin issuers, ultimately fostering growth and stability within the web3 economy.”

Stablecoins, to maintain their pegged value, must be backed by corresponding fiat currency reserves such as the US dollar, ensuring that holders can redeem their digital assets for the equivalent value in fiat. However, managing these reserves securely has posed challenges for stablecoin issuers, hindering broader adoption and creating a notable gap within the web3 community.

ZA Bank has actively embraced the burgeoning web3 landscape in Hong Kong, reporting over $1 billion in client transfer volume within the web3 sector in 2023. In response to the Hong Kong Securities and Futures Commission’s (SFC) decision to accept license applications for retail virtual asset trading platforms (VATP) in May 2023, ZA Bank announced plans to provide retail virtual asset trading services in Hong Kong. Subsequently, the bank claims to have met over 80% of VATP client banking requirements and onboarded more than a hundred web3 companies in its efforts to drive local adoption.

According to a consultation document from the Financial Services and Treasury Bureau and the Hong Kong Monetary Authority, stablecoin issuers will be mandated to obtain licenses, as announced by the Hong Kong government in December 2023. To qualify for such licensure, issuers must ensure full backing of circulating stablecoins with reserves at least equal to their par value.