Bitcoin Price Edges Up to $67K as Interest Rate Concerns Persist, ETF Enthusiasm Wanes

24/04/2024

NFT Lending Volume Hits Record $2.1 Billion in First Quarter, According to Latest Data

26/04/2024New Bipartisan Stablecoin Legislation May Favor Banks in Digital Currency Sector

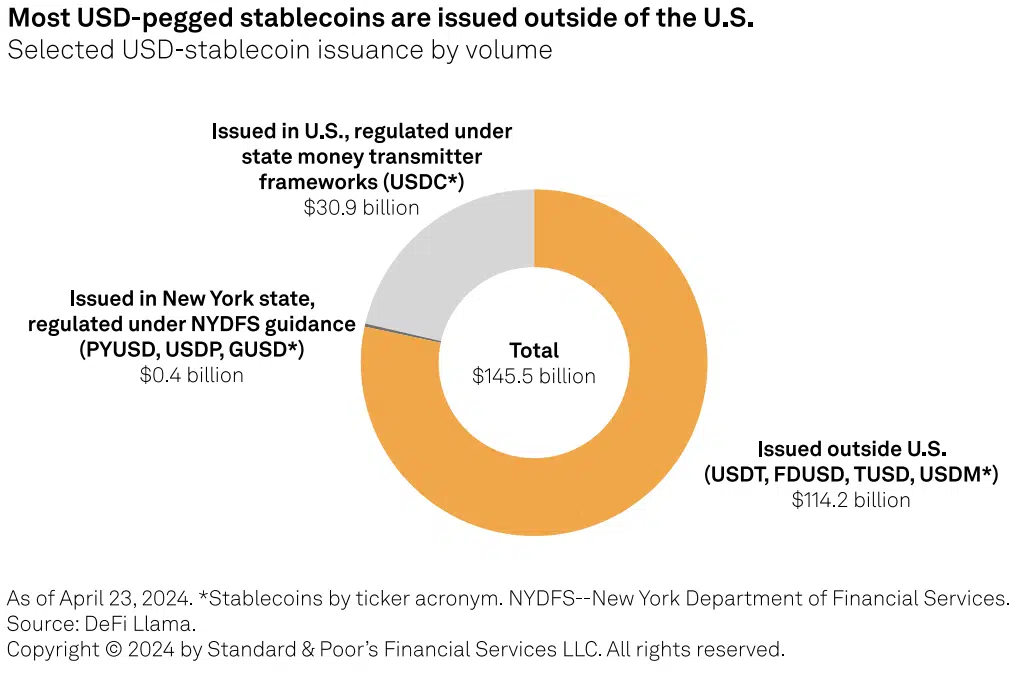

A recent analysis by S&P Global indicates that the bipartisan Lummis-Gillibrand Payment Stablecoin Act, introduced on April 17, could potentially benefit banks by providing them with a competitive edge in the digital currency custody space. This legislation aims to bring regulatory clarity to the robust $157 billion stablecoin market, currently led by Tether (USDT).

Stablecoins, which are cryptocurrencies tied to the value of fiat currencies like the U.S. dollar, provide a stable alternative within the typically volatile cryptocurrency market. Notable examples include Circle’s USD Coin (USDC), which facilitates seamless transitions between digital and traditional currencies.

Under the proposed bill, U.S. banks would be authorized to issue fiat-collateralized tokens without any predefined limits. Conversely, non-bank service providers would be restricted to a market cap of less than $10 billion.

Andrew O’Neil, Managing Director and Co-Chair of the Digital Assets Research Labs at S&P Global, highlighted that this regulatory proposal could position banks favorably against other market players by encouraging blockchain integration for asset tokenization and digital bond issuance. He pointed out that on-chain payment systems can deliver transactions that are both instantaneous and efficient, using the BlackRock Ethereum-based fund as an illustration of this capability.

While the proposed regulation would not affect U.S.-based operations like PayPal USD, it explicitly excludes offshore companies such as Tether from authorization. This could potentially undermine Tether’s market position in the U.S., as noted by O’Neil, given that much of Tether’s trading volume originates outside the country.

The bill also does not cover decentralized stablecoins, leaving cryptocurrencies like Maker’s DAI and Frax Finance’s FRAX outside its regulatory scope. According to O’Neil, this suggests a policymaker preference for more centralized solutions like USDC that align more closely with traditional financial mechanisms.

In conclusion, the S&P report anticipates a surge in new entrants within the digital asset custody field, especially following a revision in SEC regulations that exempts custodians from having to list crypto-assets on their financial statements.

Links: